triple bottom stock bullish or bearish

The falling wedge is also the inverse of the rising wedge. The first candlestick indicates a bearish trend in the first time-frame and the other indicates a bullish move in the second time frame.

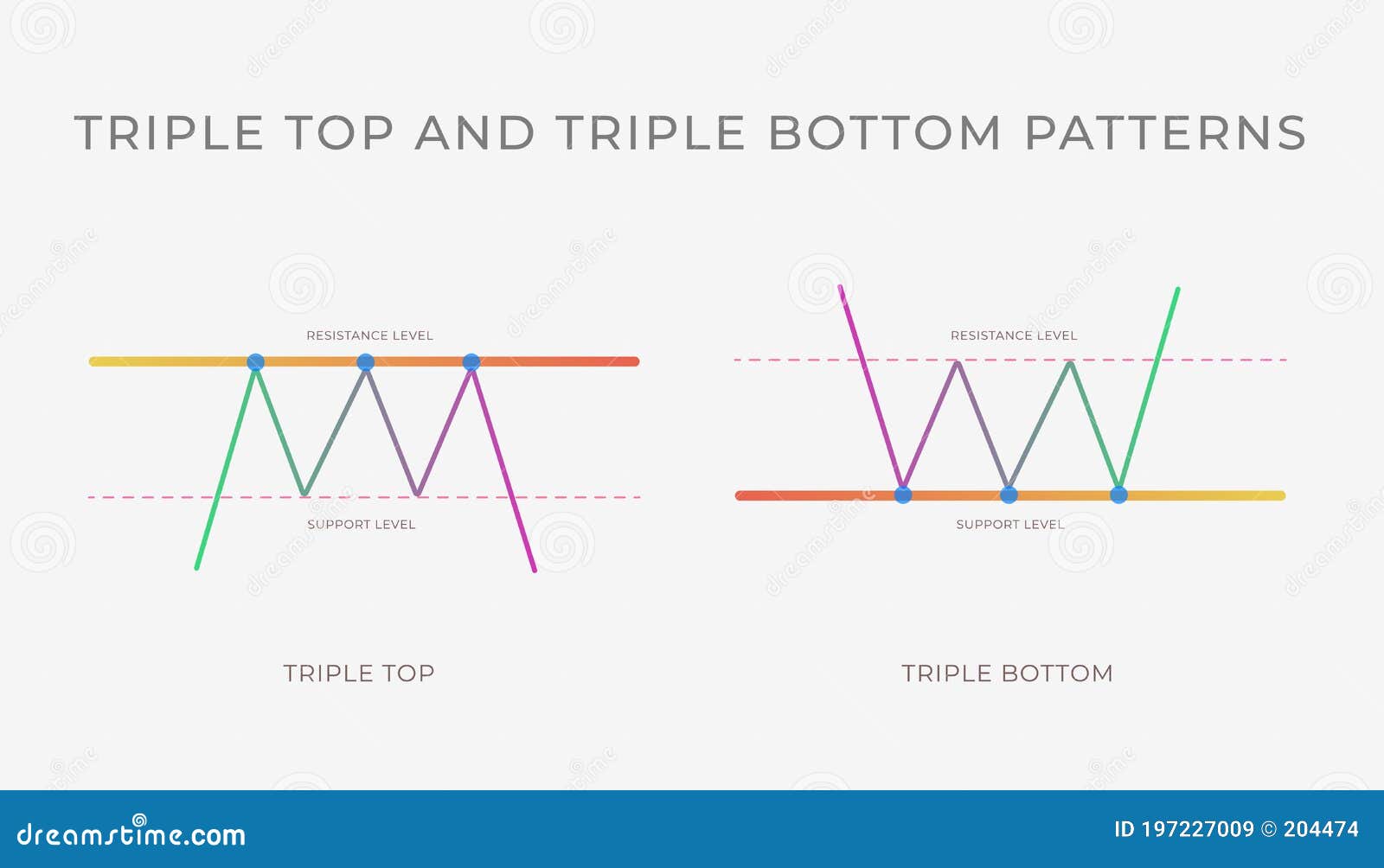

The Triple Top And Triple Bottom Pattern Trading Sos Sos

Stock market before the financial crisis of 20072008 was on October 9 2007.

. I have tried my best to bring the best possible outcome in this chart. Right-Angled Ascending or Descending Ascending. The falling wedge is a bullish indicator that can be found in either an uptrend or downtrend.

The Broadening Bottom pattern is also characterized by five small reversals however it is the opposite of the Broadening Top. Any financial and market information given on UToday is written for informational purpose only. The pattern completes when the price reverses 4 and breaks through the bottom of the rising wedge 5.

Shaven Bottom A black or white candlestick with no lower tail. Often act as a resistance level for stocks and most of the times it is broken on the downside. Conduct your own research by contacting financial experts before making any investment decisions.

Give us an example MARC. Welcome to this quick update on the TOTAL2 analysis. Bearish Harami Consists of an unusually large white body followed by a small black body contained within a large white body.

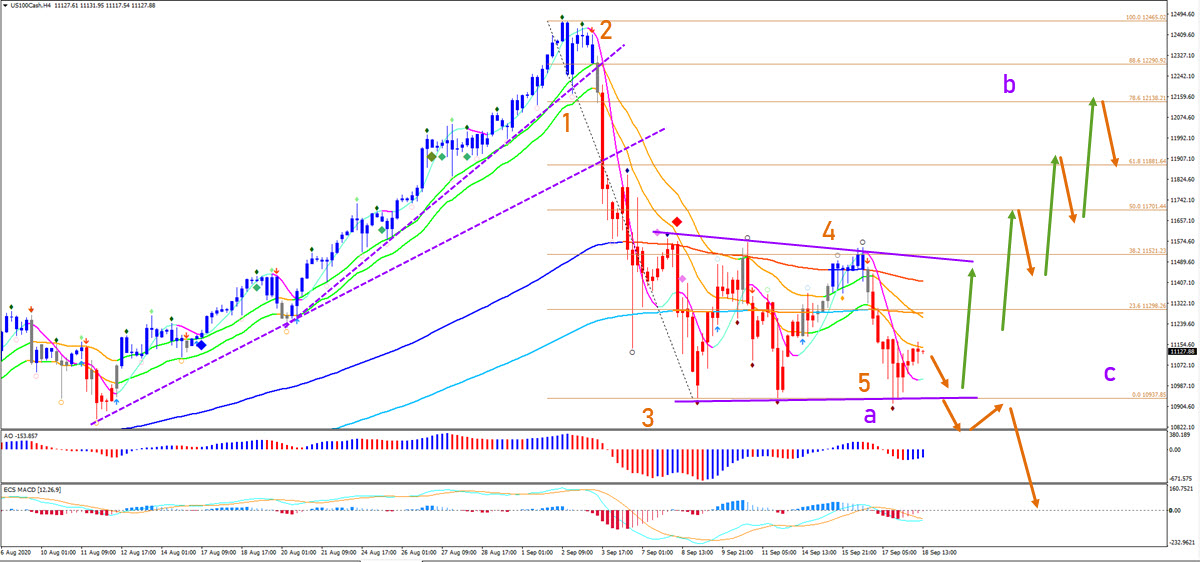

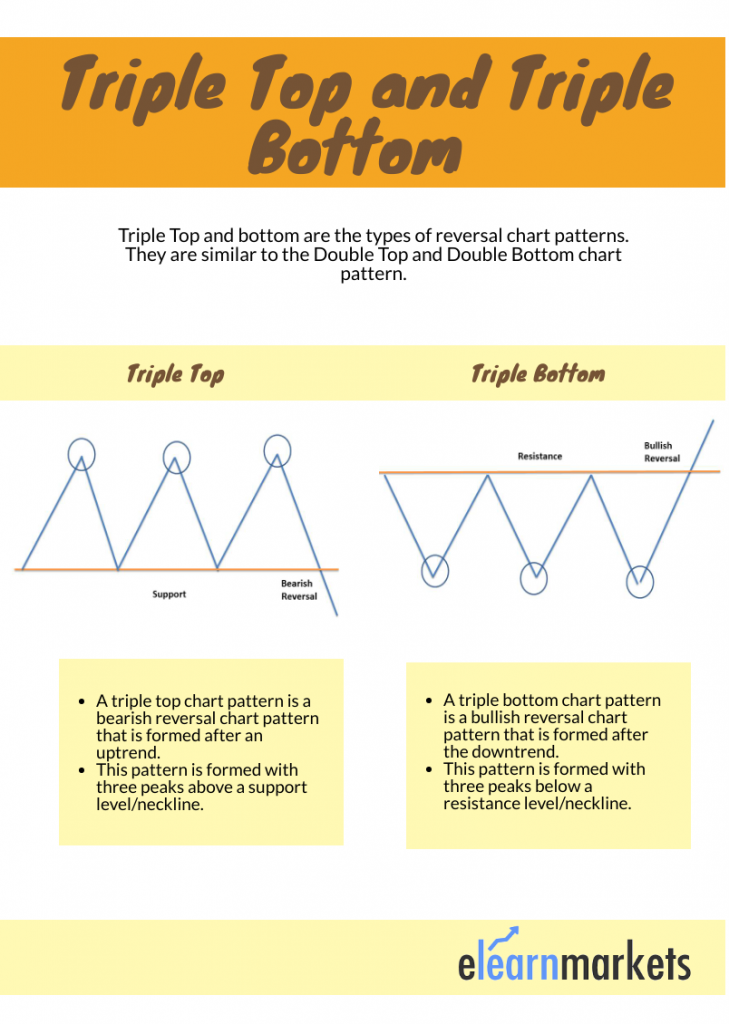

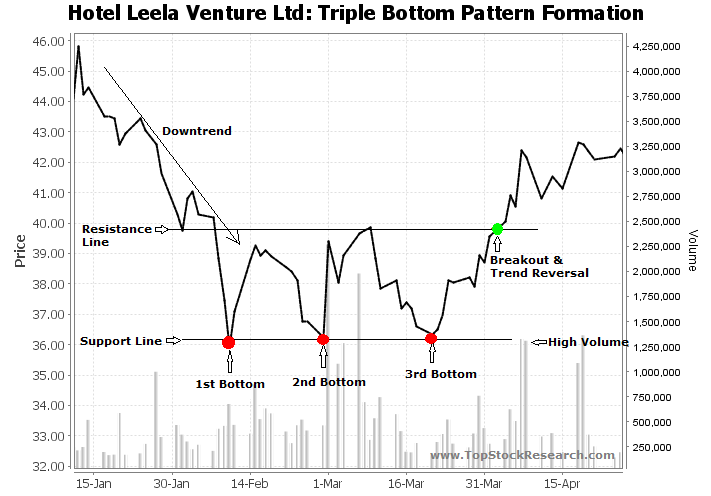

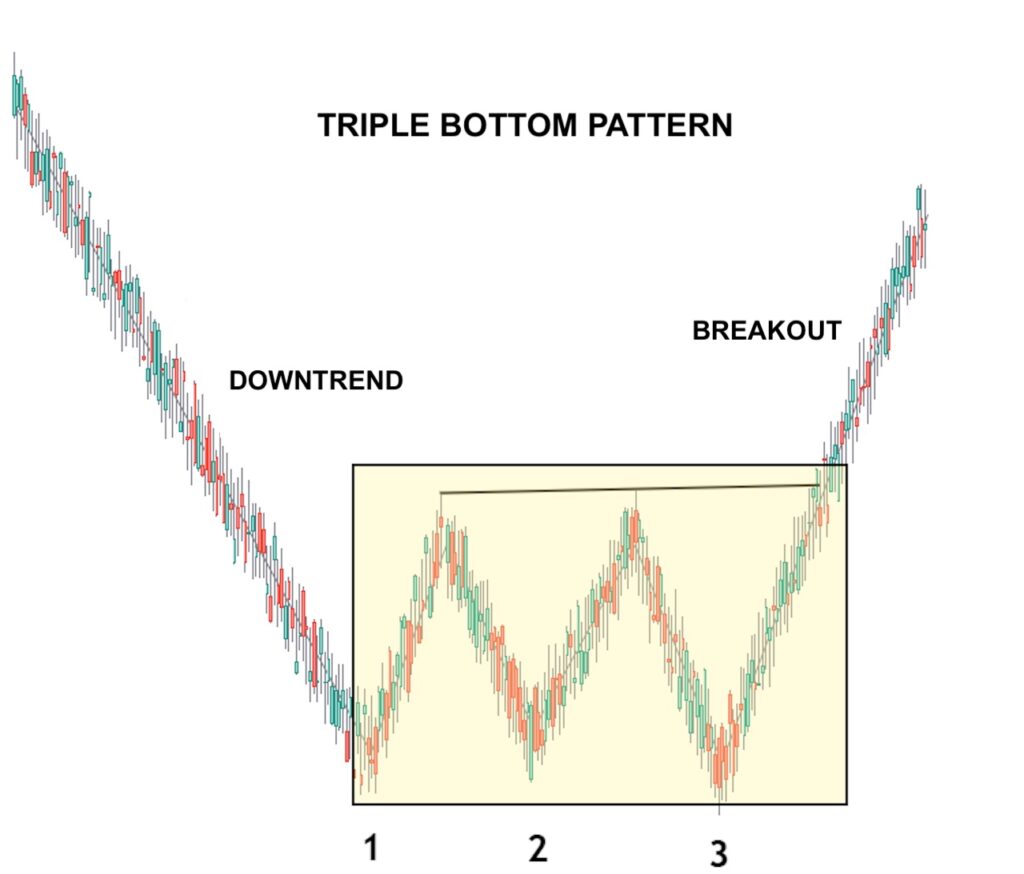

The pattern is identified when the price of an asset creates three troughs at nearly the same. It is considered a bullish pattern. It is considered a bearish pattern when preceded by an uptrend.

A piercing pattern is a candlestick pattern that gives us potential bullish reversal signs and it is formed near the support levels at the end of a downtrend. There are three main types of gaps. For both bullish and bearish traders the 100 level is highly important.

Signs of ample supplies are bearish for prices after ICE cocoa inventories last Friday rose to a 7-34 month high of 5422 mln bags. Again same as previous setup - Bearish candlesticks pattern with raising volume suggesting further decline before earning report on 17th MAY - Closed at 76 and indicators at low levels - The idea is strangle options combo between 70 and 80 for coming weeks as i expect the next move will be in range of 20 at least from current price 76. Bearish Breakdown Patterns - Double Bottom Breakdown Triple Bottom Breakdown.

Breakaway gaps runaway gaps and exhaustion gaps. It is very difficult to identify a bottom referred to as bottom picking before. Measured Move - Bullish.

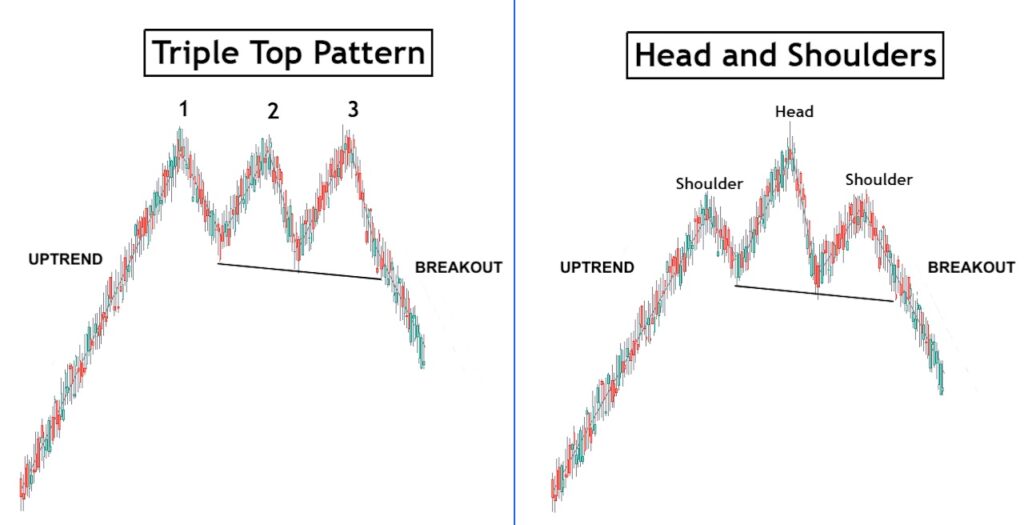

Compare with Inverted Hammer Complex patterns. This pattern is made of two candlesticks the first one is a bearish candlestick and the second. 3 Triple Top Pattern.

Bullish 3-Method Formation Consists of. Still at a mid-cap valuation of 560 billion and a historically low and now reasonable price-sales multiple of 52 SOFI stocks growth. On break-out above the resistance line.

It consists of two candlesticks and indicates a bullish reversal in a chart. Remember oftentimes a stock rated Bearish on the Power Gauge can fall and then immediately pivot. The SP 500 Index.

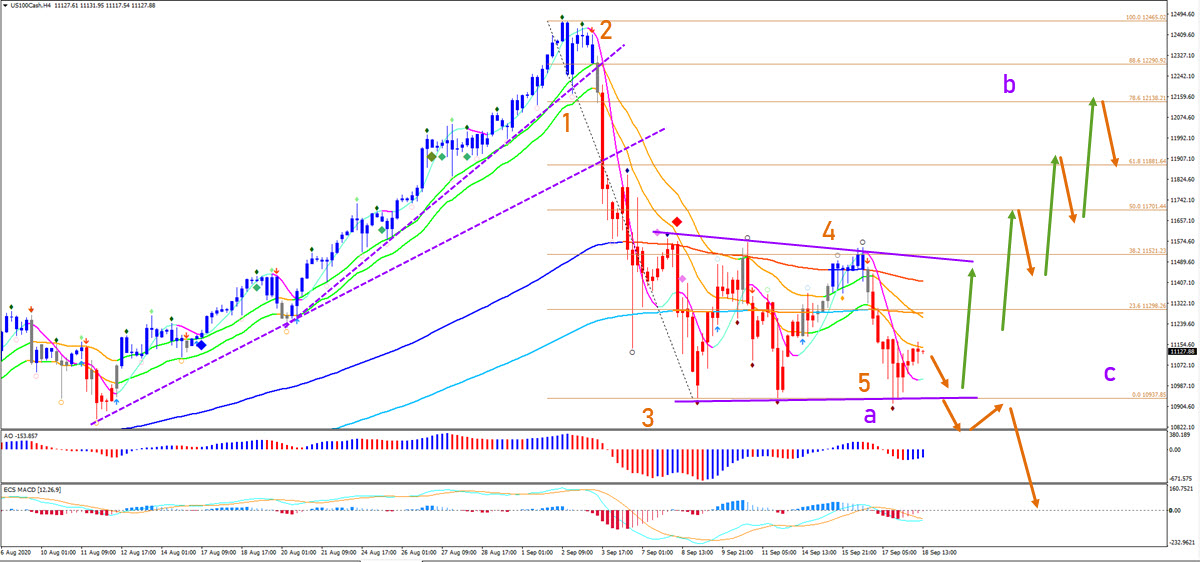

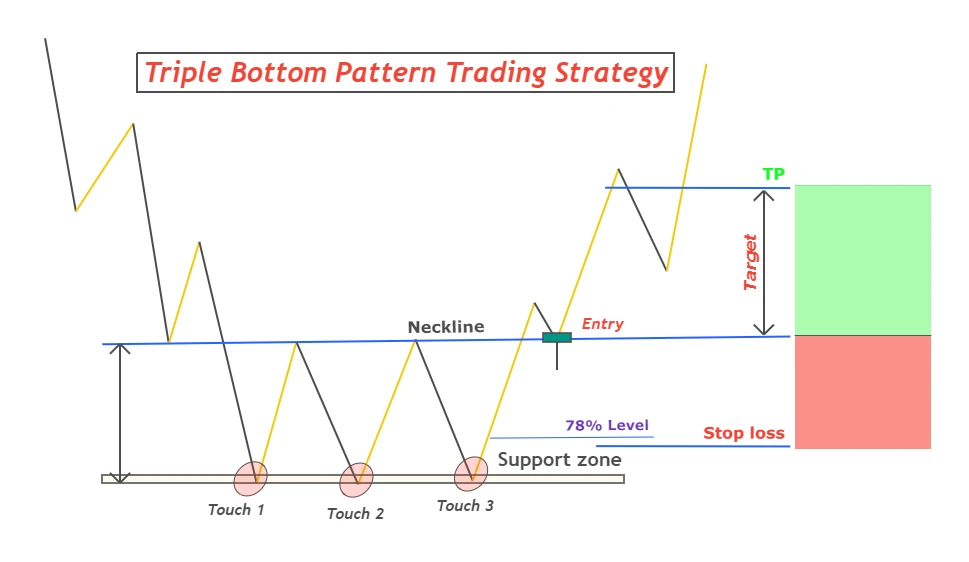

A market bottom is a trend reversal the end of a market downturn and the beginning of an upward moving trend bull market. ALTS Market Cap Analysis It is moving in a parallel channel in a bullish trend. How do we trade a Triple Top Bottom pattern.

Barchart Mon Jun 6 7. Measured Move - Bearish. The RSI is in oversold territory.

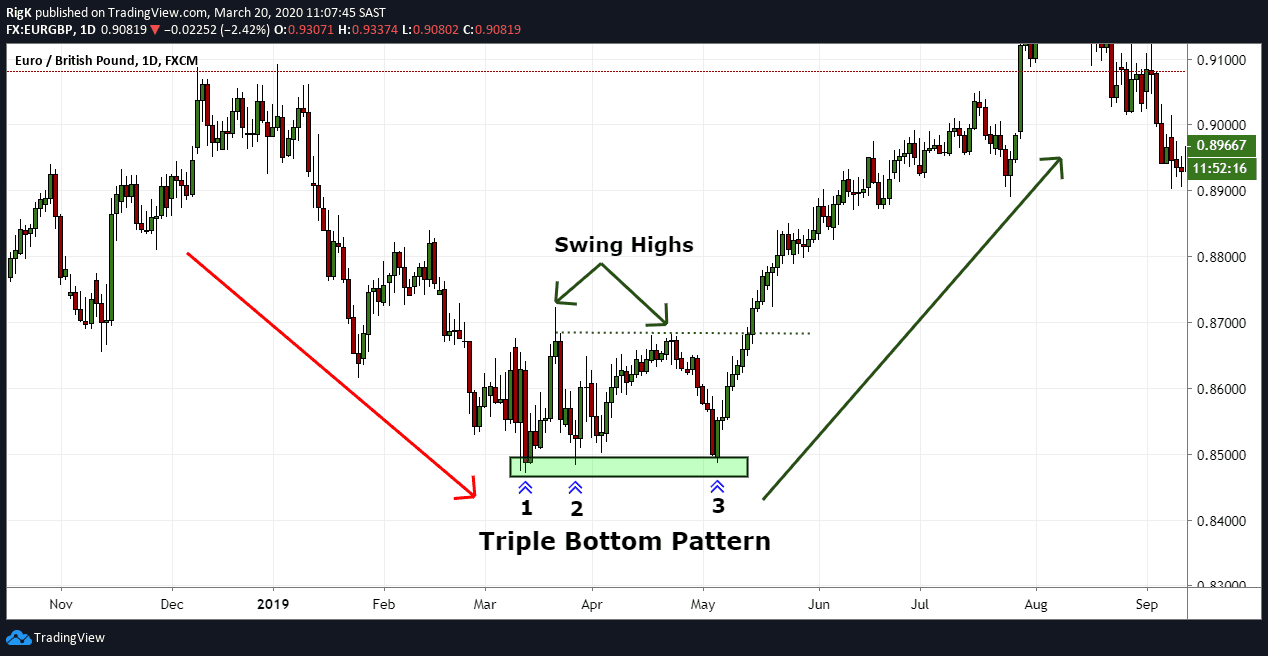

The trading method is akin to the Double Top Bottom chart pattern. Head and Shoulders Bottom. When that happens the Power Gauge turns to Bullish and the stock can take off independently of whatevers going on in the market or the economy.

A pattern used in technical analysis to predict the reversal of a prolonged downtrend. The tweezer bottom candlestick is a pattern that occurs on a candlestick chart of a financial instrument like a stock or commodity. For example a stock might close at 500 and open at 700 after positive earnings or other news.

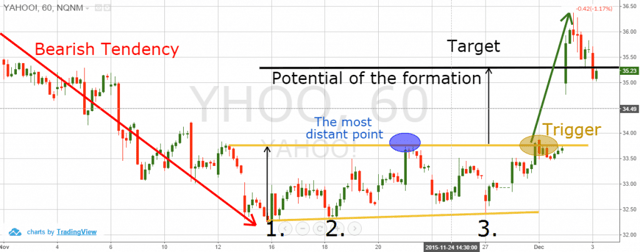

4 Triple Bottom PatternJust Opposite of Triple top pattern and many times acts as support zone for stocksExpert traders buy stocks near this support zone if other technical indicators are supporting while new to technical. The falling wedge is not a very common pattern. Bump and Run Reversal.

On pullback to the. For a Triple Bottom chart pattern buy. A bear trap suckers the sellers before rallying while a.

Below is the daily chart of Nifty 50 in which all the above 3 points are demonstrated. The peak for the US. It is currently trading above the trendline support.

This tool will download a csv file for the View being displayed. Monday Cotton Bouncing Triple Digits. For dynamically-generated tables such as a Stock or ETF Screener.

Bearish traders may choose to open a short position if the stock rejects at the level of the first rebound or if the stock falls beneath the key support level at which it created the double bottom. If Disney holds above the level a reversal to the upside is likely. Buy these 2 stocks for gains Nifty bearish trend may continue support at 15650 15500 Sensex Nifty witnessing longest weekly fall in.

Bull and Bear Traps - These patterns are exactly what they sound like. In the Broadening Bottom the reversals are followed by an advance in price not a decline. Similarly the Triple Top shows two unsuccessful tries to continue an upwards trend and signifies a bearish reversal.

Bullish and Bearish Triangles - These patterns resemble triangles in bar charts but a basic PF signal is required for confirmation.

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-02-8412f60315fe4e75801c37d04bebd526.jpg)

Technical Analysis Triple Tops And Bottoms

:max_bytes(150000):strip_icc()/dotdash_INV-final-Technical-Analysis-Triple-Tops-and-Bottoms-Apr-2021-01-4e2b46a5ae584c4d952333d64508e2fa.jpg)

Technical Analysis Triple Tops And Bottoms

Triple Bottom Reversal Chartschool

Nasdaq S Triple Bottom Could Confirm Reversal In Uptrend

Bybit Learn What Are Triple Top And Bottom Patterns In Crypto Trading

What Are Chart Patterns Explained Asktraders Com

Bearish Bullish Reversals Bdo Unibank Inc

Bybit Learn What Are Triple Top And Bottom Patterns In Crypto Trading

Triple Bottom Chart Pattern Trading Charts Stock Trading Strategies Technical Trading

What Is Triple Bottom Pattern Trading Strategy Explained Forexbee

Triple Bottom Pattern And Triple Top The Ultimate Guide

John The Rock Trading Co Di Twitter Pro Tip Triple Tops And Bottoms Are Extensions Of Double Tops And Bottoms As Posted Last Week You Can Use These Methods In Identifying

Bybit Learn What Are Triple Top And Bottom Patterns In Crypto Trading

Bybit Learn What Are Triple Top And Bottom Patterns In Crypto Trading

Triple Top And Bottom Chart Pattern Formation Bullish Or Bearish Technical Analysis Reversal Or Continuation Trend Figure Stock Vector Illustration Of Formation Chart 197227009

How To Trade Triple Bottoms And Triple Tops

/dotdash_Final_Triple_Top_Dec_2020-01-78a37beca8574d169c2cccd1fc18279d.jpg)